If a corporation has four directors and two shareholders, one owning 60 shares and the other owning 40 shares, it seems obvious that the majority shareholder should be able to elect a majority of the board of directors. Actually, the obvious answer is wrong. This scenario could end a stalemate every bit as intractable as the electoral college vote in 1801. Here's how this can happen.

Under cumulative voting, which is the rule for most California corporations and pseudo-foreign corporations, the number of votes required to elect three directors is determined according to the following formula:

X = (S * D/N+1 ) + 1 vote

In this formula, X is the number of shares required to elect a specified number of directors (D), S is the number of shares voted, and N is the total number of directors to be elected. Assuming both shareholders vote, the number of shares required to elect 3 directors (a majority of the board) is determined as follows:

X = (100 * 3/4+1) + 1 vote

Thus, 61 votes are needed to elect three directors. The majority shareholder is one vote short. By the same calculation, the minority shareholder is also one vote short. The majority shareholder will have a total of 240 votes which she'll likely distribute among 3 candidates. The minority shareholder will have a total of 160 votes which he'll likely distribute between 2 candidates. The result is that all four candidates receive 80 votes and no one is elected.

If you don't believe that this can happen, read In re Jamison Steel Corp., 158 Cal. App. 2d 27 (1958). Thanks to my friend, Jack Hudson at ONeil LLP, for pointing this out.

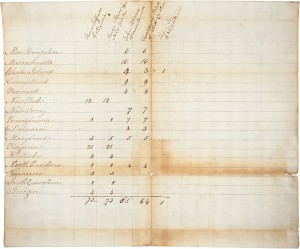

Below is The National Archive's image of the tally of the electoral college vote on February 11, 1801 in which Thomas Jefferson and his running mate, Aaron Burr, tied. The two other principal candidates listed are John Adams and his running mate Charles C. Pinckney.

.png?width=100&height=100&name=corporate_law_blogs%20(1).png)